The Smart

Renter’s Guide

The Smart Renter's Guide

Stronger credit. Smarter choices. A brighter future. Discover how my services—from credit repair to rent-to-own—can help you reach your financial goals.

Your Financial Journey Starts Here

Meet Brandy Collins

My mission is to help you rebuild credit, prepare for homeownership, protect your family, and grow in confidence—because life insurance turns loss into legacy, not debt.

Credit • Homeownership • Life Insurance Travel • Golf • Legacy Building

Struggling with credit? Dreaming of owning a home? Want easy-to-follow guides that break down complex topics? That’s where we come in. Our credit repair, rent-to-own solutions, and exclusive e-books are designed to guide you step by step toward financial freedom. Think of us as your partner in creating the future you’ve been working for.

Our Services

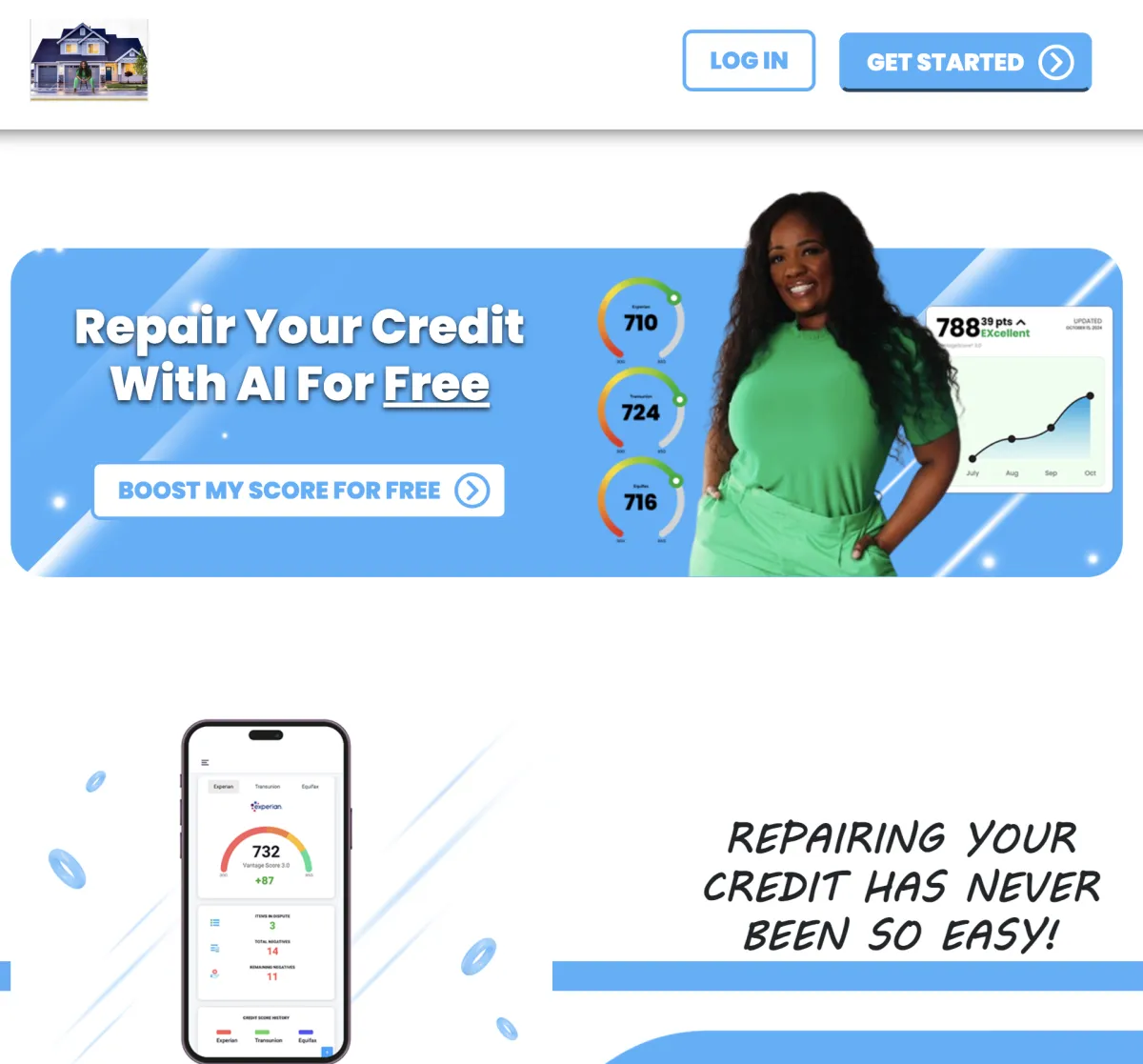

Take control of your financial future with our credit repair services. We help identify errors, remove negative marks, and provide strategies to build lasting credit health. Whether you want to qualify for a loan, lower your interest rates, or simply improve your score, our proven methods make the process simple and effective!

Dream of homeownership but not quite ready to buy? Our rent-to-own program bridges the gap. You’ll rent your home while building credit and saving toward ownership turning monthly rent payments into an investment for your future. We guide you through every step so you can move confidently toward owning your home!

Get instant access to our free e-book, “The Smart Renter’s Guide to Rent-to-Own Homes.” Inside, you’ll learn the key steps, benefits, and insider tips to make rent-to-own work for you. It’s your first step to financial empowerment and homeownership, absolutely free!

We believe every golfer has untapped potential. That’s why we combine classic instruction with today’s most advanced teaching tools, high-speed cameras, launch monitors, and data-driven swing analysis, to help you improve faster and play with more confidence.

TESTIMONIALS

What others are saying

“My credit finally turned around!”

"When I started, my credit was a mess and I felt hopeless. Within just a few months, my score improved so much that I was able to get approved for a new car. This program really works!"

“I never thought I’d own a home”

"I’ve been renting for years and thought buying a home was out of reach. Thanks to the rent-to-own program, I finally have a place I can call mine while working toward ownership. It’s the best decision I’ve ever made."

“The guide gave me confidence”

"The guide broke everything down in a way I could actually understand. It gave me the confidence to start the rent-to-own process and take control of my future."

Credit Repair

Struggling with your credit score? You don’t have to go through it alone. We work with you step by step to challenge inaccuracies, rebuild your profile, and set you up for long-term success. Imagine the relief of finally qualifying for a car, a home, or even a new credit card, it all starts here.

Credit Repair

Struggling with your credit score? You don’t have to go through it alone. We work with you step by step to challenge inaccuracies, rebuild your profile, and set you up for long-term success. Imagine the relief of finally qualifying for a car, a home, or even a new credit card — it all starts here.

Frequently Asked Questions

What is credit repair?

Credit repair is the process of identifying and addressing inaccurate, outdated, or unfair information on your credit report. It helps improve your credit score so you can qualify for better financial opportunities.

Can I repair my credit on my own?

Yes, you can dispute errors directly with credit bureaus, but many people choose professional credit repair services for faster results and expert guidance.

How long does credit repair take?

Typically, it can take 3 to 6 months to see significant improvements, depending on the complexity of your situation and the number of items being disputed.

What kind of items can be removed from my credit report?

Common items include late payments, collections, charge-offs, repossessions, foreclosures, bankruptcies, and hard inquiries—if they are inaccurate or unverifiable.

Will credit repair erase all negative items?

No. Only inaccurate, outdated, or unverifiable items can be removed. Legitimate debts will remain until they naturally fall off your credit report (usually 7 years).

How much can my credit score improve?

Results vary. Some clients see small increases, while others gain over 100 points, depending on their unique credit history.

How do credit bureaus respond to disputes?

By law, credit bureaus must investigate disputes within 30 days and either verify, update, or remove the item.